|

Articles

10 Sep 2009 “The Future of MCAD” Roundtable Organized by Isicad and upFront.eZine was held on September, 8

The roundtable was a part of Ralph Grabowski's visit to Russia. Mr Grabowski is a well-known Canadian expert on CAD, journalist and editor of the popular CAD publication upFront.eZine. He is traveling through Russia and visiting CAD software firms in St Petersburg, Moscow, and Novosibirsk. Mr Grabowski's aim is to gain insight into the Russian CAD market, describe its current state, and understand its future prospects.

The half-day roundtable took place on September 8, 2009 in Moscow at Sheraton Palace Hotel. Its 40 attendees represented all major CAD vendors operating in Russia: ASCON, Autodesk, Dassault Systemes, LEDAS, Nanosoft, NTP Truboprovod, POINT, PTC, PTS, SibCAD soft, Siemens PLM Software, Spatial, Top Systems. Reporters from CADpoint, CRN, DMK-Press, PC Week, SAPR I grafika also attended the event.

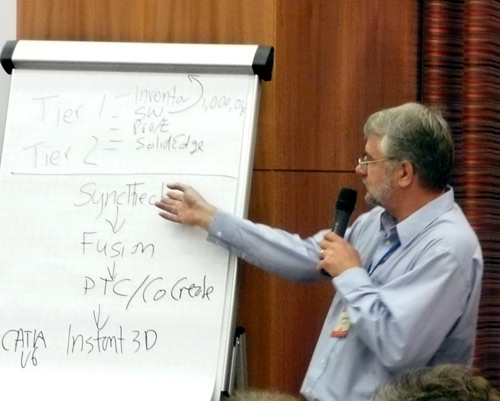

The roundtable began with Ralph Grabowski presenting a “Review of Today’s MCAD Market: Competitors, Classification, Sales Models, and Niches,” followed by discussion, and concluded with a press conference-style question and answer session. Participants discussed trends in MCAD software and hardware, international and national markets, and MCAD journalism.

Below you can see a summary of Mr Grabowski's Introductory Review followed by a picture gallery.

1. MCAD MARKET OVERVIEW

Q: What is the prognosis for competition between the top-tier MCAD packages: Pro/ENGINEER, SolidWorks, Solid Edge, and Inventor?

A: Until the recession hit, the order was:

- Inventor

- SolidWorks / CATIA

- Pro/Engineer

- Solid Edge / NX

These four are considered Tier 1 vendors. They have large installed bases, significant direct and indirect sales forces, a worldwide presence, extensive educational programs, and large marketing budgets.

Tier 2 vendors and products are Kubotek USA, Alibre, CoCreate, Rhino, IronCAD, Think3, Ashlar Vellum, SpaceClaim, and so on. They are supported by their dedicated users (SpaceClaim survives through cash infusions from investors).

The slowing of sales over the past 12 months is changing the Tier 1 order, where SolidWorks has overtaken Inventor in total number of seats licensed: over one million commercial and educational seats.

However, is becoming difficult to count seats accurately, because some vendors have stopped reporting their numbers. Even when numbers are reported, they can contain a mix of commercial, educational, free, and abandoned seats.

Q: Is the price of CAD heading up — or down?

A: The price will appear to remain static. In good times, vendors try to drive up prices deliberately; in poor times, like this year, they reluctantly drop prices.

In poor times: Vendors are afraid to raise prices this year to avoid losing sales, and afraid to lower prices to avoid losing profits.

In good times: CAD vendors raise prices by releasing extensions that cost customers extra, such as FEA, mandatory subscriptions, and bundling. For example, Autodesk plans to increase the number of software bundles it offers. These cost customers more money in total and sell more seats of bundled software, but the overall cost is less when the price of each individual item is taken into account.

Low pricing: Companies like Alibre cannot sustain prices as low as $99, and rely on up-selling, maintenance, and side-selling to bring in additional revenues. (The $99 offer for Alibre Design ends September 29.) Low pricing cannot be sustained because of royalties that must be paid. In addition, third-party developers are hurt when the CAD software is priced less than their products.

High pricing: There is only a very small market for expensive CAD (priced over US$8,000), and that market is effectively captured by Dassault Systemes, PTC, and Siemens PLM, and their sales teams.

Ideal pricing: Autodesk seems to have found the sweet-spot with AutoCAD LT's $1200-price, since the software sells 3x more copies than AutoCAD annually, despite the built-in deficiencies. Autodesk this year greatly increased the price of LT, but also uses it as an upgrade "loss-leader" gateway to more expensive software, such as paying just $2000 to upgrade to Inventor.

What can we learn from LT?

- It is priced just a bit higher than other office productivity software.

- It has sufficient drafting features to satisfy most customers.

- It does not need to offer programming, since most users have no interest in it.

- It is compatible with other Autodesk software, and so can be used for initial drafting, touch-ups, file viewing.

- It benefits from the AutoCAD name recognition (Lexus ad).

Q: How can CAD systems be distributed free — and yet make money?

A: Free CAD systems are not very popular, something that surprises me. Although most CAD vendors have a free version of their software, downloads tend to number in the tens of thousands — never in the millions. SketchUp might be an exception, but Google does not publish download numbers, and it is not CAD.

Indeed, I think customers have a psychological need to pay for CAD, and to pay more for CAD than office productivity software, since the higher price tag infers greater stability, accuracy, and security.

Q: What are prospects for software leasing or renting?

A: Poor. Customers want to own their software, just like we want to own our homes; renting a house feels temporary and un-home-like,

CAD vendors try rentals or short-term licensing from time to time, but it never proves popular. Instead, keep it on the order book in case a large project needs it.

Q: Will it ever be possible to eradicate illegal copies of MCAD; and if so, how?

A: No. Even free is not cheap enough; people want the "real" thing, even if only for bragging rights. (Look at how Hollywood has been unable to keep DVDs locked down.) Perhaps running the software off a USB key might be an answer?

Q: Is development of MCAD clones a natural development for the future?

A: No. IntelliCAD was an unnatural exception. Products need differentiation; even MicroStation veered away from Intergraph. The ITC has announced it no longer plans to copy AutoCAD slavishly, except for features that makes sense.

Instead of clones, feature-copying (aka "feature wars") will continue strong, despite patents. It will be interesting to see what happens if software patents are ruled illegal in the USA; vendors might then shift their patents to other countries.

Q: Why are there no standardization committees for CAM and PLM, as there are in telecommunications and the Internet?

A: CAD and PLM do not lend themselves to standards, because they are very flexible, complex programs. There are too many different ways to implement layers, colors, parts catalogs, parts, styles, and so on. Some government agencies and standards bodies have created standards for layers, but even these are ignored by most users.

2. TRENDS IN MCAD SOFTWARE AND HARDWARE

Q: Is direct modeling the new savior of the MCAD industry?

A: As Al Dean wrote on Develop3D: "If you have bigger players discussing a technology, there's a perception that something new has been discovered."

Direct modeling is not a savior for these reasons:

- It is new, so most users don't know how to operate it.

- It is forbidden, because for two decades users have been told repeatedly that parametric modeling is the best (and only) way to go.

- While the approach to parametric modeling is roughly similar for all CAD packages, vendors take quite different approaches to direct editing.

- For customers, it is a headache to learn another system of modeling. Perhaps pre-modeling software will become more successful, such as Rhino and solidThinking.

I recommend that MCAD vendors provide direct modeling on the side, either their own or with a bi-directional link to Rhino, etc.

Q: Who is taking the right course in direct modeling — Inventor Fusion, SolidEdge with Synchronous Technology, SolidWorks, or PTC?

A: All are fumbling right now, because it is new to each of them:

- Siemens muddied the waters with the launch of Synchronous Technology; to this day, we are not clear on how it operates.

- Autodesk has yet to prove that Fusion integrates well with Inventor.

- SolidWorks intends to add direct modeling features to Instant3D, but no details yet.

- PTC intends to add direct modeling to Pro/E, but no details yet.

Over time, they will see what works for customers and in competitor products, and then incorporate changes. Meanwhile, the companies who have long provided direct modeling software — KeyCreator, IronCAD, etc -- are frustrated with the lack of attention they receive.

In five years, direct modeling will look different from what it looks like now, due to:

- New and better direct modeling algorithms.

- Feature copying between competitors.

I think that direct modeling will increasingly become invisible to the end user as it melds with history-based parametric editing.

Q: How large a market is there for PLM and digital prototyping?

A: Small, because SMBs [small and medium businesses] cannot afford to implement them, and SMBs are the largest market.

I think that customers do not trust this technology, because:

- PLM can seem like a SAP horror story waiting to happen.

- Digital prototyping is not as trustworthy as compared to real prototypes; cf. Toyota.

I recommend that MCAD vendors without PLM not expend development resources on it, because existing PLM systems already support multi-CAD systems.

As for digital prototyping, all MCAD systems seem to be drifting in that direction, as they add simulation features and take advantage of high-horsepower devices like nVidia's GPUs.

Q: Can Autodesk continue to avoid PLM?

A: They will slowly engage it through ProductStream and other products they are acquiring and developing, slowly. They were badly burned by their first attempt 11 years ago with WorkCenter (sold to Motiva).

Q: Will MCAD benefit from interactive interface technology, such as multitouch and Microsoft Surface?

A: Only in certain areas, such as viewing conceptual models. Actual design will ignore touch, because the screen is too far away from the keyboard. What might work is a small color LCD touch screen integrated into the keyboard, like a touchpad on notebook computers.

I recommend that MCAD vendors approach multitouch as cautiously as they would speech input.

Q: Is there room for MCAD on mobile devices?

A: I would argue not, but my son now uses his cell phone as his primary computer (camera, Facebook, email, etc).

The leader in CAD software on small devices is using a 5" HTC computer for recording architectural details on-site with a laser measuring device, communicating with BlueTooth (a pain). I think 5" is the absolute smallest, and 9" the smallest practical screen size.

I do not recommend that MCAD vendors invest in any 3D development on cell phone CAD or Android devices. First, 2D has to get working on these devices.

Q: Can MCAD operate in the cloud? If so, in which way?

A: Yes, for these purposes:

- Off-loading compute-intensive operations, like rendering and FEA. However, new hardware like nVidia's GPUs, might obviate the need for assistance from cloud computing.

- Shared storage for dispersed teams.

But not otherwise, for the same drawbacks as renting MCAD software, and the very public failures of uptime.

I recommend that MCAD vendors investigate feasibility of the cloud, perhaps in conjunction with Amazon and other established cloud providers. For users, I recommend they be very careful about relying on cloud computing/storage, and only use it as alternative outsource solution.

Q: What impact can Linux have on the MCAD market?

A: It will lower the overall cost of CAD in two ways:

- No-cost OS, other than optional paid support

- Less-demand on the hardware compared with the overhead from Windows.

However, the savings from these two advantages are minimal compared to the high price of high-end MCAD. I suspect companies will be as hesitant to switch to Linux as to direct modeling — it is an unknown with dubious advantages.

I recommend that MCAD vendors start writing OS-independent code to insure themselves in case Linux or Mac takes off. For users, I recommend they create Linux test beds.

3. INTERNATIONAL AND NATIONAL MARKETS

Q: What is the level of technology for design and manufacturing in North America?

A: The North American market is considered mature, which means that it is difficult to make new sales. Sales tend to be upgrades or competitive switches.

Q: What is the best way for Russian and western CAD vendors to compete with each other in the Russian market?

A: Perhaps by forming alliances, combining knowledge of local Russian markets with the marketing experience of Western firms.

Q: How should Russian software companies position themselves in the western market?

Q: What are the chances for Russian MCAD systems, like KOMPAS and T-FLEX, to succeed internationally?

A: Frankly, I see no possibility of Russian companies making any inroads in Western countries. Instead, they should consider "ignored" areas of the world, such as South/Central America, Africa, and former Soviet lands. There are several reasons for this:

- The Western market is already crowded with the two tiers of MCAD vendors. Others, like think3, have retrenched back to their home land (Italy, in their case).

- Russians have no CAD software market presence or mindshare in the West. They are seen as excellent programmers of Pro/E, Open Design Alliance, etc, but not as the source of original CAD programs.

- The poor English translations of their press releases and manuals is off-putting. For example, I could barely read the "English" installation instructions for one Russian CAD package sent to me for evaluation.

I recommend that MCAD vendors hire native English-speaking editors to North American-ize their initial English translations.

Q: Is government support and/or protectionism strategically useful?

A: I am against government support and protectionism.

Government support and protectionism artificially prop up firms that would otherwise fail in the (capitalist) marketplace. Firms who receive funds and trade protection from government are under no pressure to run their operations efficiently.

Government subsidies allows failing firms to compete unfairly and "successfully" against otherwise-successful firms that do not receive subsidies from government, and possibly drives them out of business. The artificial success lasts a limited amount of time only, for once government support ends (as it always does), subsidized/protected firms quickly go out of business.

The result is two sets of failed businesses: (1) those who could not compete against the subsidized firms, and (2) those who relied on the "mother's milk" of government subsidy/protection.

I support only one kind of government "subsidy": lower taxes, which benefit all firms equally.

Q: How can Russian CAD users be persuaded to go beyond buying "just the box" to spending more on highly qualified support and training?

A: Customers should always have the option of going it alone (operating "just the box"), or obtaining help. If customers need help, then they should have options for sources of help:

- Free online forums (users helping users).

- Free or paid training in classrooms, or self-learning from books and other media.

- Paid assistance from the vendor or independent providers.

I recommend that MCAD vendors provide a variety of support and training mechanism, because one method of learning does not suit everyone -- nor every wallet. Provide different levels of paid support (cheap and slow; expensive and fast and dedicated); encourage third-party development of training materials, books, videos, and so on; provide support online forums; encourage blogging.

4. MCAD JOURNALISM

Q: How is the MCAD media influenced by the transition from paper to blogging?

A: Blogging is a disruptor, as seen by the number of newspapers and magazines shutting down -- and not just in the CAD world.

I think blogging is more important than most CAD editors realize. Blogging gives us:

- Instant news (instead of news that delayed by 2-3 months in magazines).

- Frequent news (instead of news delivered once a month).

- Fresh news, as the talent of new writers is discovered, such as Matt Lombard, Deelip Menezes.

- Aggressive news, as independent bloggers write their uncensored thoughts, unencumbered by the worry of losing big-paying advertisers.

Bloggers are a low-cost method of marketing for cash-strapped MCAD vendors. Most bloggers would be thrilled to have a 30 to 60-minute interview with an executive.

In time, the newness of blogging will die out as it becomes tedium for most people; this will leave a core of dedicated writers. In contrast, I don't see that Facebook, Twitter, or Second Life have any place in CAD.

I recommend that MCAD vendors nurture enthusiast bloggers in the way that Autodesk and SolidWorks have successfully done.

Moderators: Vladimir Malukh(LEDAS) and Ralph Grabowski

Introductory talk of Ralph Grabowski

Kirill Gantmakher and Akop Aznaurian (POINT)

Maxim Bogdanov and Alexander Magomedov (ASCON)

Vitaly Bespalov and Steffen Buchwald (Siemens PLM Software),

Alexander Tasev (Autodesk)

Variety of emotions about CAD

Olga Akulova (Siemens PLM Software) and Dmitry Kraskovsly (CAD & Graphics Review)

Vadim Pyanov and Leonid Korelstein (NTP Truboprovod)

Elena Goretkina (PCWeek/RE)

Andrei Bulanov (PTC)

Artem Avedyan (Dassault Systemes)

Directors of marketing:

O.Akulova (Siemens PLM Software), T.Kulikova(POINT), A.Morozova (Autodesk)

Three Serges from Top Systems: Kuraksin, Bikulov, and Kozlov

CAD is sometimes fun

CAD is sometimes not fun: Vyatcheslav Klimov (PTS)

Igor Hanin and Maxim Egorov (Nanosoft)

See also:

Permanent link :: http://isicad.net/articles.php?article_num=13280

|

|