|

Articles

4 Sep 2012

Cyon Research compares Russian and global trends of CAD use (with comments by isicad.ru)From the editor-in-chief of isicad.ru/isicad.net: The origin of this paper, written by editors of isicad.ru, is explained in the introduction. The paper is commissioned by the publishers of the Russian Edition of the Autodesk Community Magazine (ACM), and its canonic version is recently published in a long-awaited third issue of the Magazine. The difference of this version of the paper is that nearly all sections end with brief subjective comments from isicad editors. The comments are based not only on the analytical data from Cyon Research, but also on our knowledge of the specifics of the CIS market and our own interpretation of such specifics: naturally, Cyon Research, Brad Holtz and ACM publishers are not responsible for the viewpoint of isicad.ru.

I’d like to repeat the statement the authors made to conclude the paper: active participation in the surveys carried out by Cyon Research on a regular basis across the globe, and since recently in the CIS, is directly beneficial for the participants – at least those who, instead of riding blind, intend to act on the market on the basis of the knowledge about the market trends and positioning their companies in line with these trends.

Cyon Research is one of the most reputable international consulting firms in the CAD / PLM field that helps industrial companies chose the right strategy and direction of development. Cyon Research thinks that its strong point is the studies enabling to predict market development for 3-6 years. Cyon Research follows the principle: we help customers understand where they should move and how they should get to the desired position, but we do not lead them by the hand. Consulting - the key activity of Cyon Research - is supported by authoritative publications (that can be found, for instance, on a well-known Internet resource www.cadcamnet.com) and events organization. The most important of such events is COFES (The Congress on the Future of Engineering Software), which first took place in 1999 and is now universally recognized as the pivotal event on the global CAD /PLM market, where industry leaders meet to discuss the main market trends.

The President of Cyon Research and COFES Congress, Brad Holtz is an analyst of international fame, a highly reputable expert on engineering software, who also consults on related investment and legal issues. Customers of Brad Holtz include: Adobe, Autodesk, Bentley Systems, Boeing, Dewberry, EDS, Gensler, Hewlett-Packard, Intergraph, Kaiser Aerospace, Lockheed Martin, Mobil Oil, Oce-USA, PTC, SolidWorks, Tekla, Siemens PLM Software, Xerox, etc. In September 2010, Brad Holtz visited Moscow to take part in COFES-Russia/isicad workshop and was a speaker at Autodesk-CIS Forum. In the beginning of October 2012, Brad is expected to be a speaker at the Autodesk University Russia.

The President of Cyon Research and COFES Congress, Brad Holtz is an analyst of international fame, a highly reputable expert on engineering software, who also consults on related investment and legal issues. Customers of Brad Holtz include: Adobe, Autodesk, Bentley Systems, Boeing, Dewberry, EDS, Gensler, Hewlett-Packard, Intergraph, Kaiser Aerospace, Lockheed Martin, Mobil Oil, Oce-USA, PTC, SolidWorks, Tekla, Siemens PLM Software, Xerox, etc. In September 2010, Brad Holtz visited Moscow to take part in COFES-Russia/isicad workshop and was a speaker at Autodesk-CIS Forum. In the beginning of October 2012, Brad is expected to be a speaker at the Autodesk University Russia.

One of the research techniques used by Cyon Research is a questionnaire survey regularly carried out across the globe on various aspects of company policy. Chief executive officers and experts are asked questions about equipping and using CAD/PLM tools (in broader terms - engineering software). The questionnaire covers a wide list of subjects, but is composed in such a way that it is not hard to answer the questions and one does not spend more than half an hour to do it (a questionnaire example can be seen here).

The value of Cyon Research survey and follow-up analysis is that along with general market conditions and forecasts of market development, it accounts for human factors affecting industry development. The examples of such factors include, in particular: difference of opinions between rank-and-file staff and chief executive officers about the need for upgrading; opinions about possible budget expenditures; assessments by staff members as to how their company differs from other companies; criteria for choosing software; and the like. All such data are broken by regions, the size of companies, positions of company officers, etc. Such data are very useful in practice because they can be compared with the situation of a particular company to help determine the company positioning, expose shortcomings, take certain factors into account for planning, etc.

Reports of Cyon Research, which are based on the survey findings, enjoy considerable authority and are in demand on the global market. After Brad Holtz visited Russia in 2010, isicad.ru translated the questionnaires into Russian and since them Cyon Research has been conducting surveys of CIS companies. Upon a request of Autodesk CIS and the editors of Autodesk Community Magazine (ACM), Brad Holtz analyzed the state of CIS market and its development based on the survey findings and compared the main trends on Russian and global markets.

Maria Zueva interviewed Brad Holtz for ACM. This interview, where the Head of Cyon Research commented the data collected by his company, served as the basis of the paper prepared by the editors of isicad.ru.

Who Were the Respondents of Cyon Research Survey?

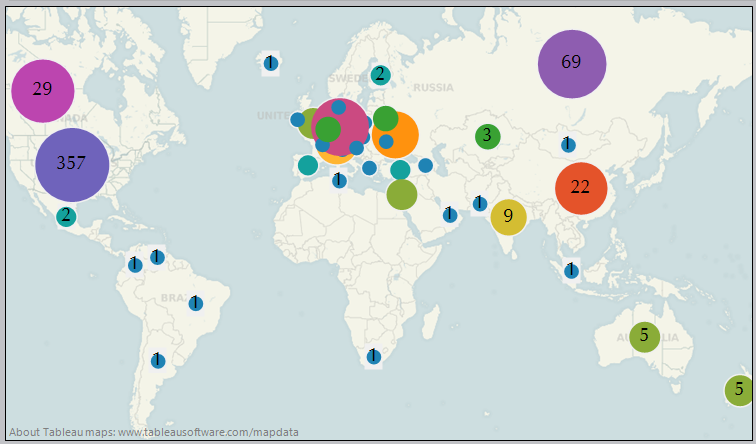

Fig. 1 shows the geographical breakdown of the respondents. The overall number of the respondents was 670 persons, including 69 from Russia.

Fig. 1. Geographical breakdown of the respondents

Comments of isicad.ru. We’d like to point out high activity of Russian respondents: comprising over 10% of all survey participants. We were ahead of all countries except the USA, including Germany and France. It seems that the Russia’s sample was sufficiently representative to form opinions and evaluate the trends.

Which CAD-Systems are Used in Machine-Building?

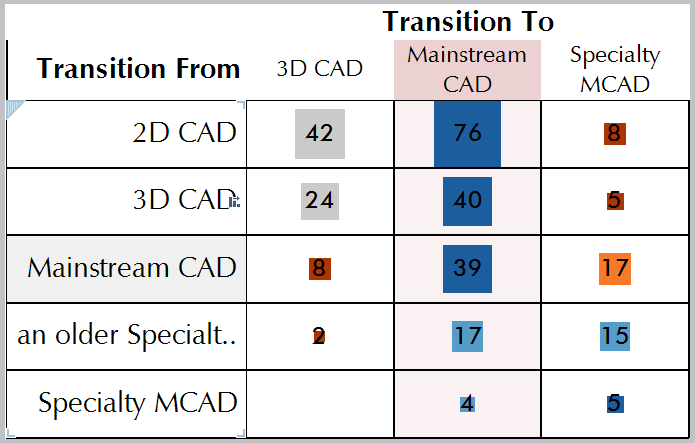

Cyon Research divided all CAD-systems into four functional classes: 2D CAD (AutoCAD LT, DraftSight, ZWCAD, etc.), 3D CAD (AutoCAD, SpaceClaim, etc.), mainstream MCAD (Autodesk Inventor, SolidWorks, Solid Edge) and specialty MCAD (CATIA, NX).

The Table (Fig.2) shows what classes of CAD-systems are used by the companies throughout the world and what are the trends on transition from one class to another (the number of companies resolving to make a move).

Fig. 2 Choosing CAD-systems in machine-building

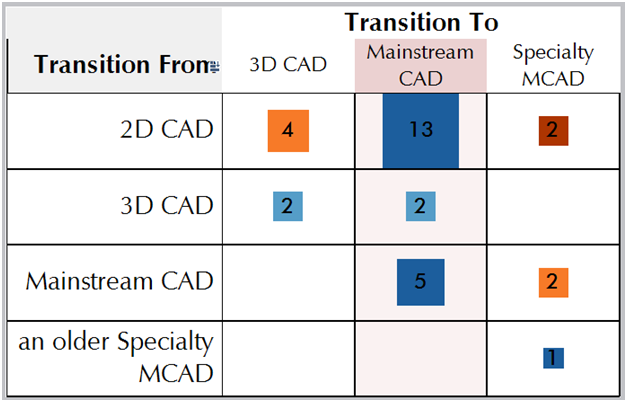

A similar Table for comparison, based on the answers given by the respondents from the CIS (Fig. 3):

Fig. 3 Choosing CAD-systems in the machine-building sector in the CIS

It’s comforting to point out that the dominant trend is the same: a transition from 2D CAD to mainstream MCAD-systems (SolidWorks, Autodesk Inventor and their analogs).

isicad.ru. Russian market has its specifics. For instance, due to the obvious reasons (CAD were underdeveloped and were not widespread until mid-90s), for a long period such classes like mainstream CAD (high-end CAD) and specialty CAD, were absent in Russia. Instead 2D CAD were used (first of all, AutoCAD), primarily by large companies that could afford buying and using PC. That’s why on the Russian market there is a clear overbalance in transition from 2D immediately to high-end CAD. At the same time, use of specialty CAD is still limited.

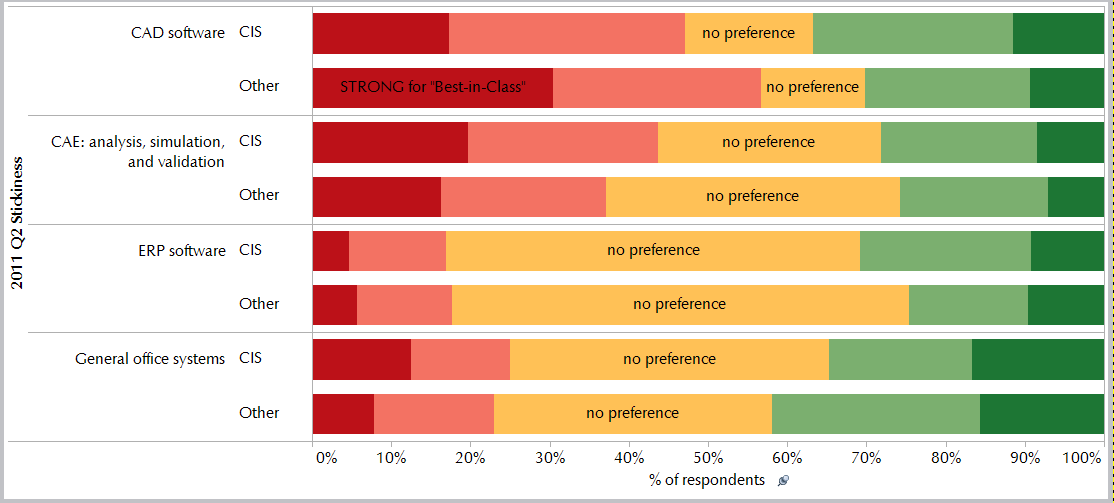

The Best-in-Class Solution or an Integrated Package?

One of the most controversial issues for software vendors (as well as for their customers) is a relative importance of the best solutions in a particular class and the best integrated solutions (with products of other classes). To obtain an answer, Cyon Research formulated the following survey question: “When it comes to buying software for design and construction (including BIM, PLM, digital mock-up, CAE, etc.), my company typically chooses:

- strongly “the best-in-class solution” (percentage of such answers is shown in red on the diagram below),

- “the best-in-class solution” rather than “well integrated with other-class solutions” (pink),

- no preferences (grey),

- “well integrated” rather than “the best-in-class solution” (light-green),

- strongly “well integrated”.

The respondents were asked to give answers for each software class separately: CAD, CAE, ERP and office software. The questionnaire specified that preference of “the best-in-class” solution implies the best possible choice in terms of a particular discipline and readiness to independently solve issues on interoperability of the chosen solution with applications from other disciplines; while a “well integrated package” means preference of well-integrated with each other solutions even if some of them are not “the best-in-class”.

Fig.4. “The best-in-class” solution or a “well integrated” package of solutions?

Looking at the diagram (Fig.4), it is possible to conclude that there is not much difference between the answers of the CIS companies and companies from other regions of the world. Just selecting CAD software, the CIS companies do not display such pronounced inclination towards “the best-in-class” solutions (30% companies across the globe always chose such solutions while in the CIS the figure is less than 20%).

isicad.ru. Still, there is some specifics. Due to historic reasons, (first of all, illegal copies have been in use for a long period), Russia and the CIS have specific range of products and versions of CAD software. That is why domestic companies prefer to chose integrated products rather than consider functional superiority in a particular class. To even a greater degree, it is true for ERP systems and office software.

Work Stations: to Expand or to Reduce?

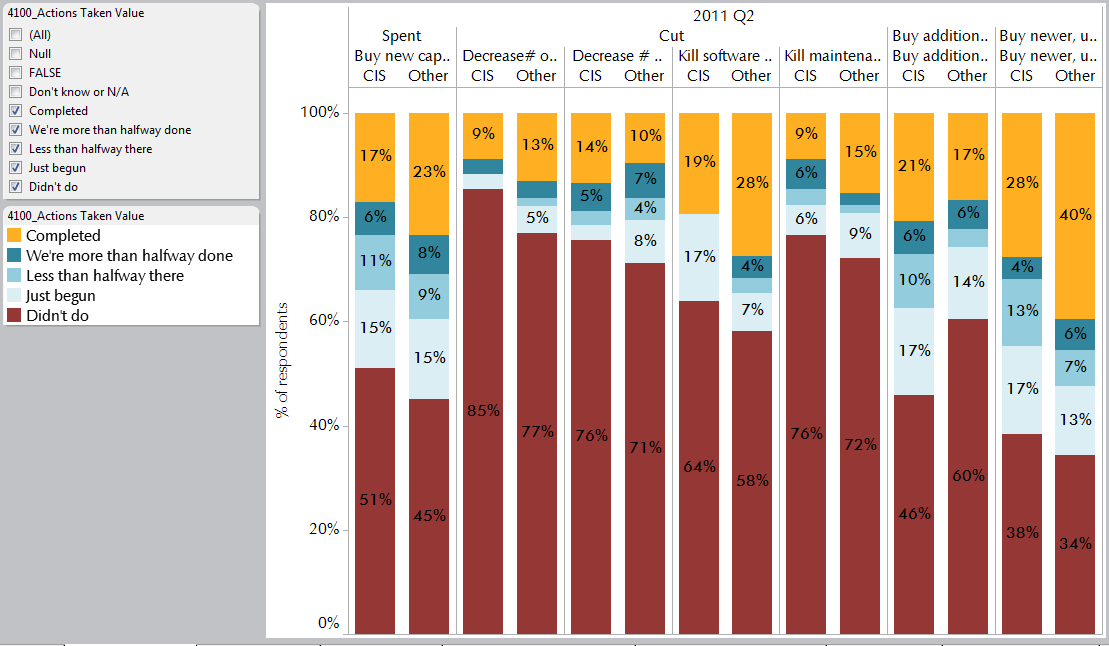

One of the key questions from Cyon Research was about upgrading engineering software. The respondents were asked whether their companies had bought new software (or expanded the functions of already bought software), expanded (or on the contrary reduced) the number of licensed work stations, upgraded software versions, refused technical support. If these processes took place within the past 12 months, the respondents were asked to specify the stage of these processes (fully completed - yellow (Fig. 5), completed for more than half - turquoise, less than half - blue, just at the beginning - light-blue, or such actions were not taken - red).

The diagram on Fig. 5 shows the breakdown of the answers to this question. It appears that companies in the CIS tend to be more conservative than in other countries: they expand or reduce the number of work stations less frequently. There is an important exception: in the past year domestic companies bought engineering software work stations more often than companies abroad.

Fig. 5. How have the number and functionalities of licensed work stations with engineering software changed?

isicad.ru. For a long period Russia and the CIS not only invested less in new software but also put less robust efforts towards cutting down the costs by reducing the number of licenses and decreasing expenses for technical support. There are two main reasons: 1) In general it is not typical for the CIS to buy full technical support; 2) Overall there are no experiences and skills on reducing and optimizing costs.

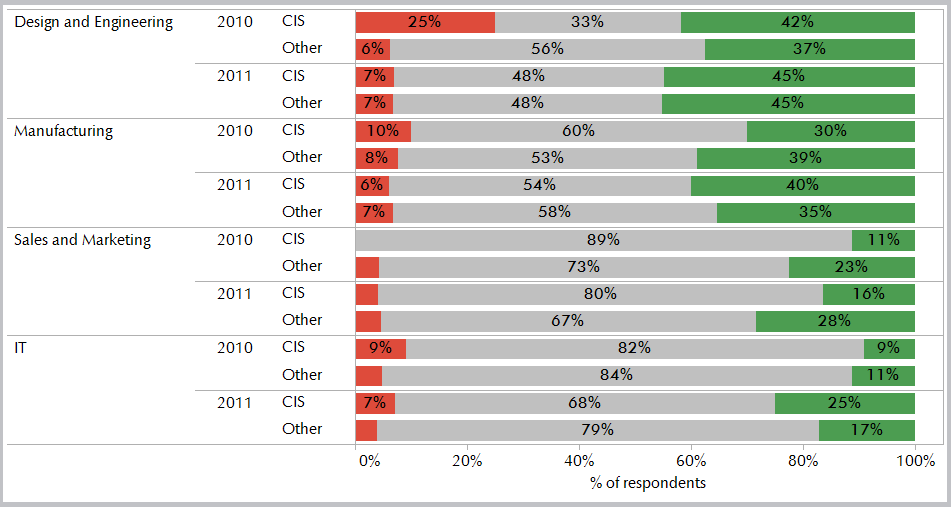

Fig. 6 The breakdown of lay-offs / hiring by sectors

The diagram shows percentage of hired staff (green), lay-offs (red), and absence of any changes (grey). The most pronounced difference between the CIS and other companies is in hiring for development, and marketing and sales services. The trend for development hiring is clearly positive and in 2011 the figures for the CIS and the rest of the world equalized. The CIS companies still pay considerably less attention to sales and marketing than companies from other regions.

isicad.ru. Overall, we agree with the general assessment of Cyon Research. In addition, however, we’d like to emphasize a growing tendency to over-evaluate company’s in-house IT-units, which indicates a low level of general qualification of staff who require more support from IT-specialists. It also implies that IT-support in the form of leased services is less popular.

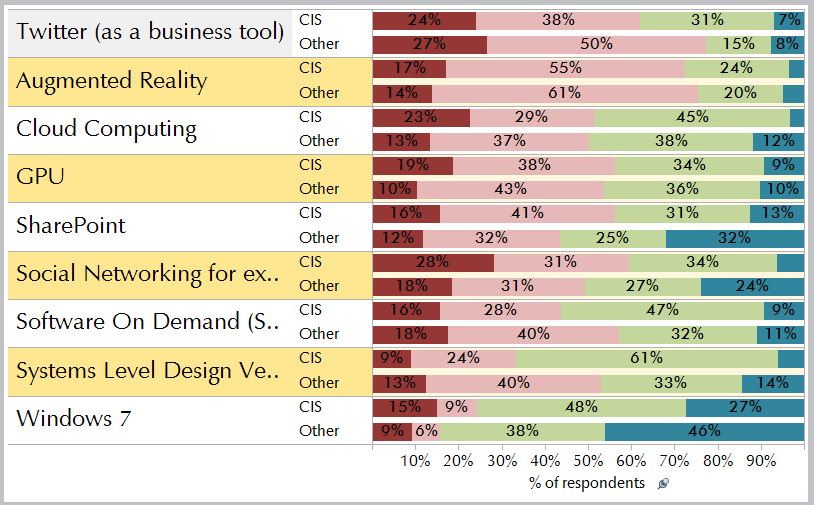

New Technologies

Cyon Research closely monitors how companies implement new technologies. Fig. 7 shows preferences of domestic users in comparison with the global trends. The percentage of negative answers (the company rejected a particular technology) is given in red, pink marks the answers of those who did not pay attention to a specific technology, light-green - those who paid attention, and turquoise - those who have implemented or began to implement a new technology.

Fig. 7 Introduction of new technologies

With approximately the same percentage of skeptics and pioneers in the CIS and in the rest of the world, dramatically stand out a threefold lag of Russian companies in implementing SharePoint (in use by one third of foreign companies against only 13% in the CIS) and a twofold gap in a transition to Windows 7 (nearly half of foreign companies have already done it against only around 25% of domestic companies). Also the respondents from the CIS are different in their negative attitude to cloud calculations and use of social networks to discuss work issues.

isicad.ru. It is possible to suggest that a low popularity of SharePoint is partly compensated with ready-made industry solutions from Russian companies, first of all, 1Ñ. The reluctance to move to Windows 7 can be explained by certain conservatism of IT-services and, simply by sabotage from the “grassroots” level, especially with regard to retraining personnel to use a new OS. Besides, obsolete equipment often stimulates use of Windows XP rather than newer OS versions as having stricter productivity requirements.

Costs Breakdown

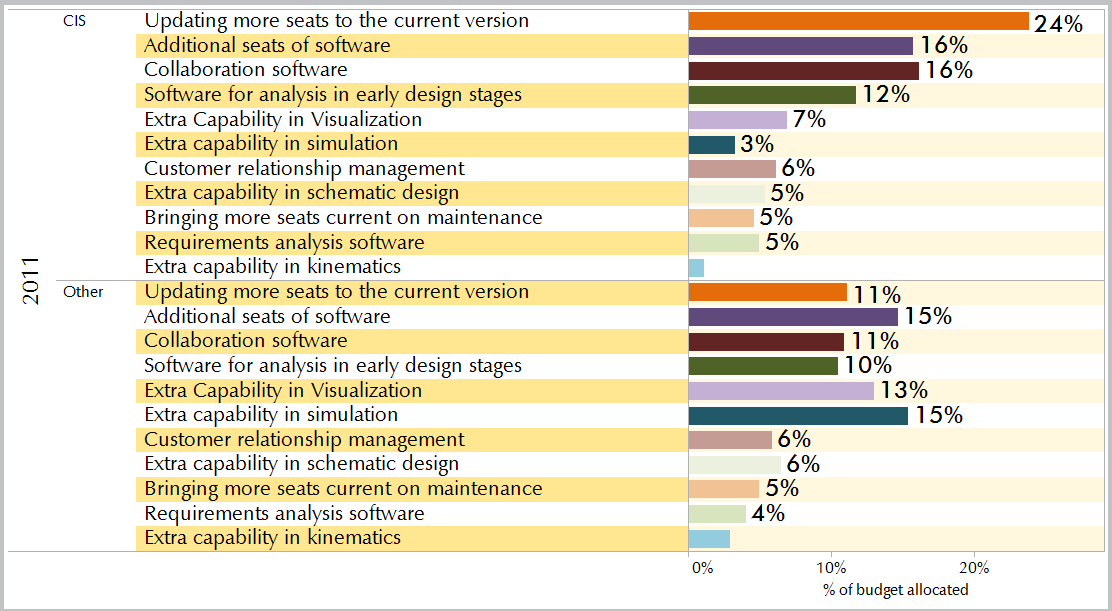

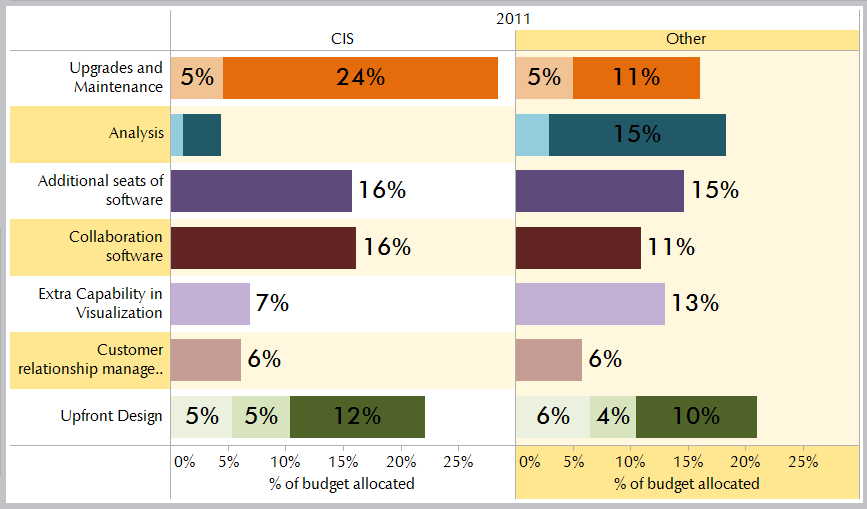

Fig. 8 Software costs breakdown in the CIS (top) in comparison with the rest of the world (bottom)

Fig. 9 Software costs breakdown in the CIS and the rest of the world according to functionalities

Tables 8 and 9 display statistics on the answers to the following question: “If additional 10% are added to the budget of your company, how will you allocate them between several key industry business-processes?” It demonstrates considerable difference between the countries of the CIS and the rest of the world. Specialists outside the CIS are much more interested in additional capabilities of engineering simulation and visualization tools. The CIS companies would spend a far bigger portion of their funds for buying new software versions. At the same time, the interest towards acquiring additional work stations and engineering analysis tools at an early stage of design is practically identical.

isicad.ru. Considerable overestimation of a newer version of the main software is evident, along with an open mistrust of the tools for engineering analysis and visual simulation of products at all stages of design. Most probably the reasons lie in the fact that such global decisions are made at the level of top executives, who are poorly aware of modern engineering simulation capabilities and, therefore, prefer “manual” product tuning, as well as in traditional Russian neglect of exterior design and ergonomics.

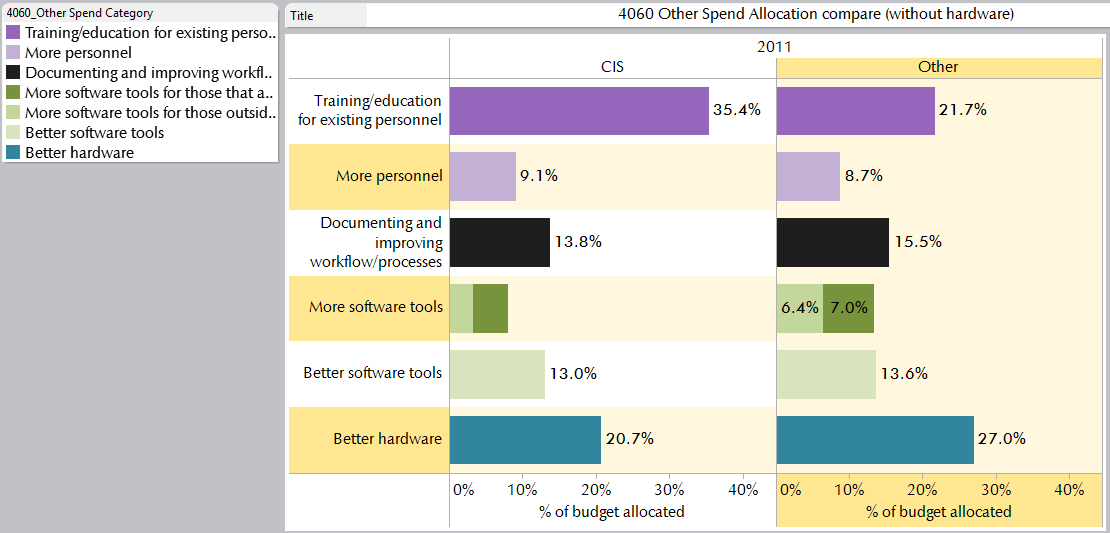

Fig. 10 The breakdown of other IT costs except buying licenses

In general the CIS companies (on the left) and companies from other countries (on the right) agree upon the costs for engineering IT (not including purchases of software licenses). Nevertheless, there is a considerable difference: the CIS companies intend to invest more in staff training and advancing qualification, while others prefer to increase investments in more efficient software. The most obvious explanation is that other countries already have trained personnel; on the other hand, companies in the CIS acquire new hardware for new work stations which makes the hardware base less obsolete.

isicad.ru. A visible trend for significant investments in advancing staff qualification, undoubtedly cannot but please. However, it is alarming that investments in already not the most advanced and modern hardware are insufficient. It can result in decreased productivity of work stations, leading to increased labor inputs, and, therefore, increased lead-time, further raising the costs.

Plans for the Future

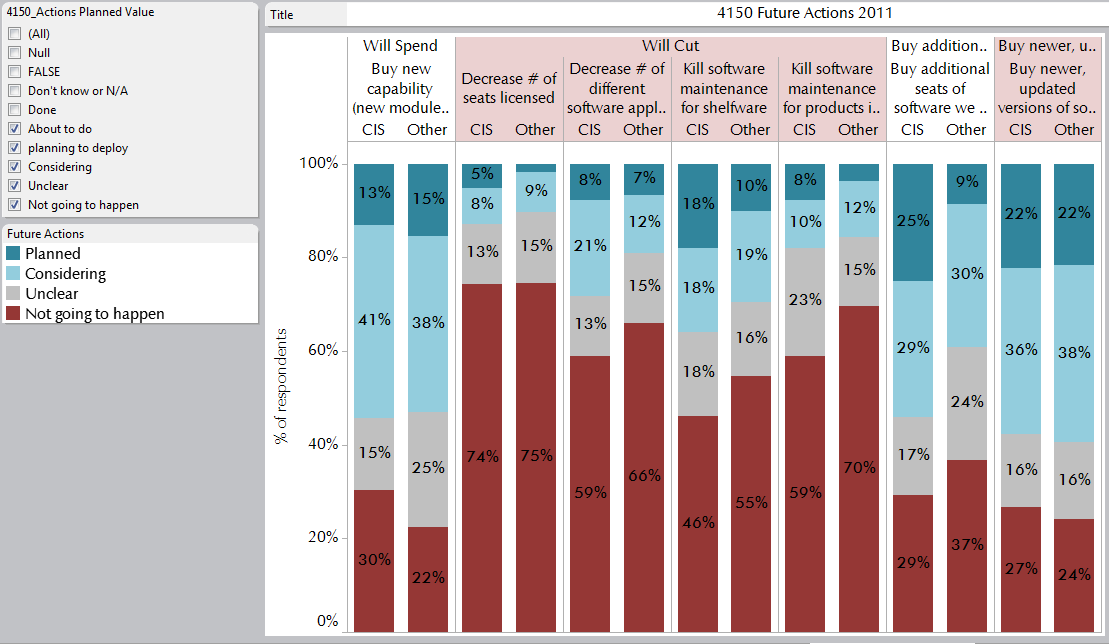

Fig. 11 Plans for 2012

The diagram 11 demonstrates the plans for the next twelve months. The red shows actions that should not happen; grey - actions that can hardly happen; light blue - “we are considering this”; and blue -“we already plan to do this”. Here changes also are very positive. The most principal, and at the same time, positive difference between the respondents from the CIS and other countries is that the CIS companies plan to buy more software in addition to what they possess now.

isicad.ru. Underestimating the role of technical support – an intention to decrease relevant expenses or completely forego it – is an alarming trend. Firstly, it will decelerate and decrease efficiency of implementing new software versions. Secondly, to a considerable extent it undermines the market of consulting services of high-skill technical support and implementation, which anyway is not really developed.

Objectives and their Priority

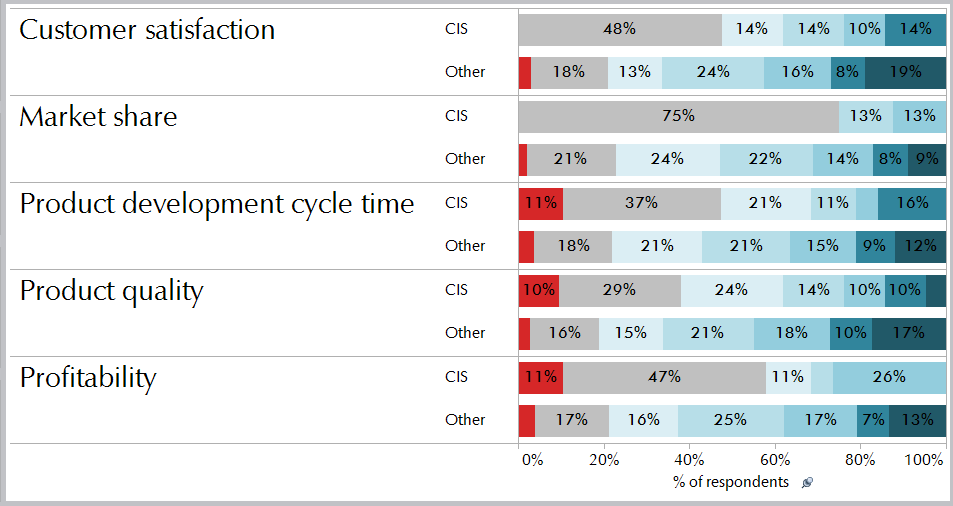

Fig. 12 Priorities in achieving various objectives

This Table shows the percentage, for which respondents plan to strengthen various factors in the next year: increase their market shares, boost the level of customer satisfaction, enhance product quality, raise profitability, or reduce product development cycle time.

The red shows that the situation would worsen and blue indicates improvements. Expectations regarding growth of market shares in the CIS are quite low; although these estimates are, perhaps, much more realistic. 75% respondents from the CIS stated that they did not expect increasing their market share in the next year. Expectations outside the CIS are considerably more optimistic: particularly, with regard to profitability.

isicad.ru. The pessimism, especially with regard to increasing product quality and reducing production cycle, and, consequently, profitability, is rather depressing. Forecasting that a market share is not going to change, perhaps, reflects some sort of production apathy and lack of healthy aggressiveness, which is important for being competitive on the market.

Conclusion

Overall, the survey demonstrates many considerable discrepancies between users of engineering software in the CIS and abroad. On the one hand, such discrepancies reflect the difference in economic development (both the current level of the economy and the rates of growth); on the other hand, they indicate a number of problems, because of which domestic industry in general is still unable to offer world-class products.

Recognizing that these discrepancies generally correspond with the present-day situation, the authors do not exclude that the findings may be somehow corrupted because the sample of domestic respondents was not large enough. Although information about the survey was actively disseminated in the CIS, users and vendors often ignored our requests. We encourage companies to be more active with furture Cyon Research surveys: just answering our questions, which is not labor-consuming, will help you better understand the situation with your company, any problems and possible ways to resolve them. At the same time, large-scale involvement will facilitate a more adequate assessment of the CIS market in general, which will be useful and valuable for domestic companies no less than for Cyon Research. Finally, the survey participants will be provided a free copy of our review (the standard price is $2000), characterizing the global market and the trends of its development.

isicad.ru. For our part, we will use every effort to further expand the survey coverage of the Russian-speaking audience.

See also:

Permanent link :: http://isicad.net/articles.php?article_num=15555

|

|