|

News

11 Feb 2009Preliminary Statistics from CIMdata Show a 6% "Mainstream PLM" Market Growth for 2008ANN ARBOR, Michigan, February 9, 2009—CIMdata, the leading global Product Lifecycle Management (PLM) consulting and research firm, today released its preliminary 2008 worldwide Mainstream PLM market results. Mainstream PLM is a subset of the Comprehensive PLM market (see explanatory note about CIMdata’s PLM market perspectives later in this press release), which encompasses market sectors that have traditionally been the most closely associated with PLM, including:

- Mechanical Computer-Aided Design (MCAD), both Multi-Discipline and Design-Focused

- Digital Manufacturing

- Simulation and Analysis

- Non-Bundled Numerical Control (NC)

- Comprehensive collaborative Product Definition management (cPDm)

- Related Systems Integrators, VARs, and Resellers

CIMdata has traditionally released its full PLM market analysis, which includes an analysis of both the Mainstream and Comprehensive PLM market around the end of March each year. However, this past year has seen the emergence of an unusually volatile economic situation that has impacted industries and markets around the world. In this environment, CIMdata has decided to release this preliminary perspective on estimated 2008 Mainstream PLM market performance to provide an earlier insight into market dynamics that are affecting both companies investing in PLM as well as PLM solution suppliers. Additional details of this analysis will be released over the coming weeks, with CIMdata’s more extensive PLM market analysis to be provided around the end of March as usual. Note that CIMdata’s estimates are based on a combination of primary and secondary data collection, long-time relationships with market participants, and market modeling based on many years of market knowledge and experience.

Based on CIMdata estimates, in 2008 Mainstream PLM experienced 6% growth from $15.040 billion in 2007 to reach $15.960 billion in 2008. “This performance reflects recognition of the importance of PLM as a competitive differentiator for industrial companies.” explained Mr. Ken Amann, CIMdata Director of Research. “In spite of the impact of the global economic downturn, companies are continuing to invest in PLM programs and technologies. However, the current economic environment is causing companies to review, and in some cases refocus their PLM investments to better meet their immediate business goals.” Mr. Amann continued, “In the first half of 2008, almost all PLM suppliers had solid growth. During the third quarter of 2008, sales and revenues began to flatten, and in the final quarter many companies had a decrease in quarter over quarter sales and revenues. While PLM continues to be an important investment, CIMdata expects that sales and revenues in 2009 will be dampened from the growth rates experienced over recent years.”

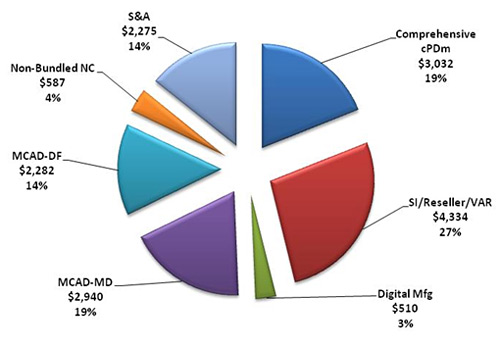

Looking deeper into the various sectors comprising the Mainstream PLM market, CIMdata’s estimates show that investments in all but one of the sectors experienced growth in 2008 over 2007. Comprehensive cPDm grew to $3.032 billion, a 10.9% increase. Investments with Systems Integrators/VARs/Resellers increased 4.9% to $4.334 billion. Digital Manufacturing investments grew by 8.5% to $510 million. Multi-Discipline MCAD grew 2.4% to $2.940 billion, while investments in Design-Focused MCAD grew 11.6% to $2.282 billion. The Simulation and Analysis sector of the Mainstream PLM market also experienced a modest growth of 4.9% to reach $2.275 billion in 2008. The only area that experienced a decrease in investments in 2008 was Non-Bundled NC, which was estimated to drop 5.0%. to $587 million. The distribution of these investments as components of the full Mainstream PLM market is illustrated in Figure 1.

Mr. Amann said, “While there are many companies participating in the PLM market, a few have distinguished themselves as PLM Mindshare Leaders.” These companies are typically considered to be at the forefront of the market in terms of thought leadership or revenue generation. PLM Mindshare Leaders have broad-based capabilities that support a full product lifecycle-focused solution. CIMdata’s PLM Mindshare Leaders for 2008 include Dassault Systèmes, Oracle, PTC, SAP, and Siemens PLM Software.

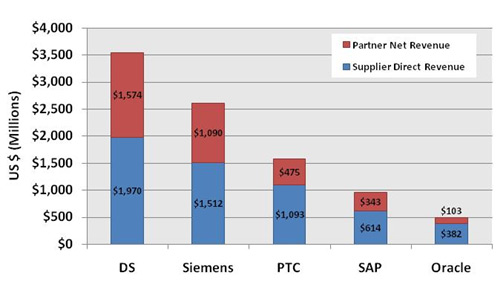

PLM Mindshare leaders sell and deliver some or all of their products and services through their field sales and support organizations. This is their core or direct revenue. Each also has an expanded “market presence” due to their partners who sell software and provide services based on the Mindshare Leaders’ technologies and products. The combination of end customer investments, both directly with a software supplier and through their partners, can greatly expand the visibility and impact of a supplier in the industry, generating a significant market footprint. Based on these combined revenues, CIMdata’s estimates for global Mainstream PLM market presence and direct revenues for the PLM Mindshare Leaders are shown in Figure 2. Note that all partner revenues are adjusted to eliminate royalties and any double-counting.

Based on CIMdata estimates, Dassault Systèmes was again the Mindshare PLM market presence leader in 2008 with a market share of 22%. Siemens PLM Software had the second highest PLM market presence with a 16% share of the market. PTC held a 10% share of the 2008 Mainstream PLM market, while SAP and Oracle had 6% and 3% shares respectively. The ranking order for direct revenues of these Mindshare Leaders were the same as for market presence, and their direct revenue market shares were: Dassault Systèmes (12%), Siemens PLM Software (9%), PTC (7%), SAP (4%), and Oracle (2%). Mr. Amann commented, “As a whole, the PLM Mindshare Leaders control an increasingly large portion of the market. In 2008, the combined market presence of these five suppliers comprised almost 60% of the total Mainstream PLM market.”

In addition to the PLM Mindshare Leaders, two other PLM suppliers that derive significant software-related revenues from Mainstream PLM market sectors are Autodesk and IBM. Autodesk has not been included in the PLM Mindshare Leaders group due to their lack of focus on overall lifecycle management aspects of PLM, and the accompanying market perception of them as primarily a “tools” supplier. IBM has not been included in this group due to the general market perception of them as a services-only supplier, although their revenue based on their own PLM-related software continues to increase. Both of these organizations contribute substantially to the Mainstream PLM market and are recognized as major PLM suppliers.

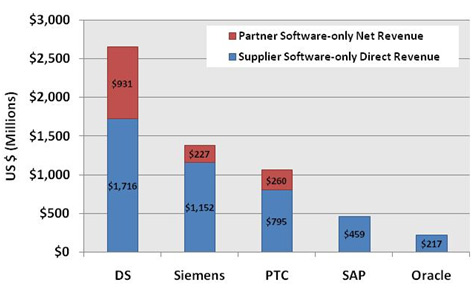

However, total revenue isn’t the only way of evaluating PLM suppliers. In 2008, all PLM Mindshare Leaders achieved growth in software—including new licenses/seats sales. Considering software-only revenue is important because PLM Mindshare Leaders are all primarily software-focused companies that derive the majority of their revenues from software—not from services. Figure 3 illustrates the PLM software-only revenues of the PLM Mindshare Leaders. As with Figure 2, Figure 3 illustrates both market presence and direct revenue performance for the suppliers.

Mr. Amann noted that while 2008 showed continued growth for the PLM market and its suppliers, the impact of the economic downturn was clearly felt during the latter part of the year. The PLM suppliers’ challenge for 2009 will be to work with their customers (the companies investing in PLM) to sustain and expand the use of PLM. This will help industrial and other PLM users to become more effective in the use of PLM technologies and best practices. “Those companies that sustain investment in PLM can become more cost efficient both by reducing cost and better leveraging existing resources. Importantly, investing in PLM will position companies to develop and deliver market leading products as the global economy improves,” said Mr. Amann.

About PLM

CIMdata defines PLM as a strategic business approach that applies a consistent set of business solutions in support of the collaborative creation, management, dissemination, and use of product definition information across the extended enterprise from concept to end of life—integrating people, processes, business systems, and information. PLM forms the product information backbone for a company and its extended enterprise.

About CIMdata’s PLM Market Perspectives

CIMdata’s PLM market analysis provides two perspectives on PLM. Comprehensive PLM covers the full product definition over the entire product lifecycle, and across all industrial industries including mechanical, electronic, and software components, as well as both discrete and process industries. Mainstream PLM reflects a view of PLM that incorporates a subset of the Comprehensive PLM market, but includes the sub-sectors that have traditionally been addressed by the major suppliers (i.e., drivers) of the PLM market—the traditional core discrete mechanical functions. Mainstream PLM is comprised of the following major market sub-sectors: Comprehensive cPDm, Systems Integrators/VARs/Resellers, Digital Manufacturing, Multi-Discipline MCAD, Design-Focused MCAD, Simulation and Analysis, and Non-Bundled Numerical Control (NC). Comprehensive PLM includes all of Mainstream PLM, and includes the additional market sub-sectors: Electronic Design Automation (EDA), Architecture-Engineering-Construction (AEC), Focused Applications, and Other Tools.

About CIMdata

CIMdata, an independent worldwide firm, provides strategic consulting to maximize an enterprise’s ability to design and deliver innovative products and services through the application of Product Lifecycle Management (PLM) solutions. Since its founding more than 25 years ago, CIMdata has delivered world-class knowledge, expertise, and best-practice methods on PLM solutions. These solutions incorporate both business processes and a wide-ranging set of PLM enabling technologies.

CIMdata works with both industrial organizations and suppliers of technologies and services seeking competitive advantage in the global economy. In addition to consulting, CIMdata conducts research, provides PLM-focused subscription services, delivers education programs, and produces several commercial publications. The company also provides industry education through international conferences. CIMdata serves clients worldwide from locations in North America, Europe, and Asia Pacific.

To learn more about CIMdata’s services, visit our website at www.CIMdata.com or contact CIMdata at: 3909 Research Park Drive, Ann Arbor, MI 48108, USA. Tel: +1 (734) 668-9922. Fax: +1 (734) 668-1957, or Siriusdreef 17-27, 2132 WT Hoofddorp, The Netherlands. Tel: +31 (0)23 568-9385. Fax: +31 (0)23 568-9111.

See also:

Permanent link :: http://isicad.net/news.php?news=12895

|

|